|

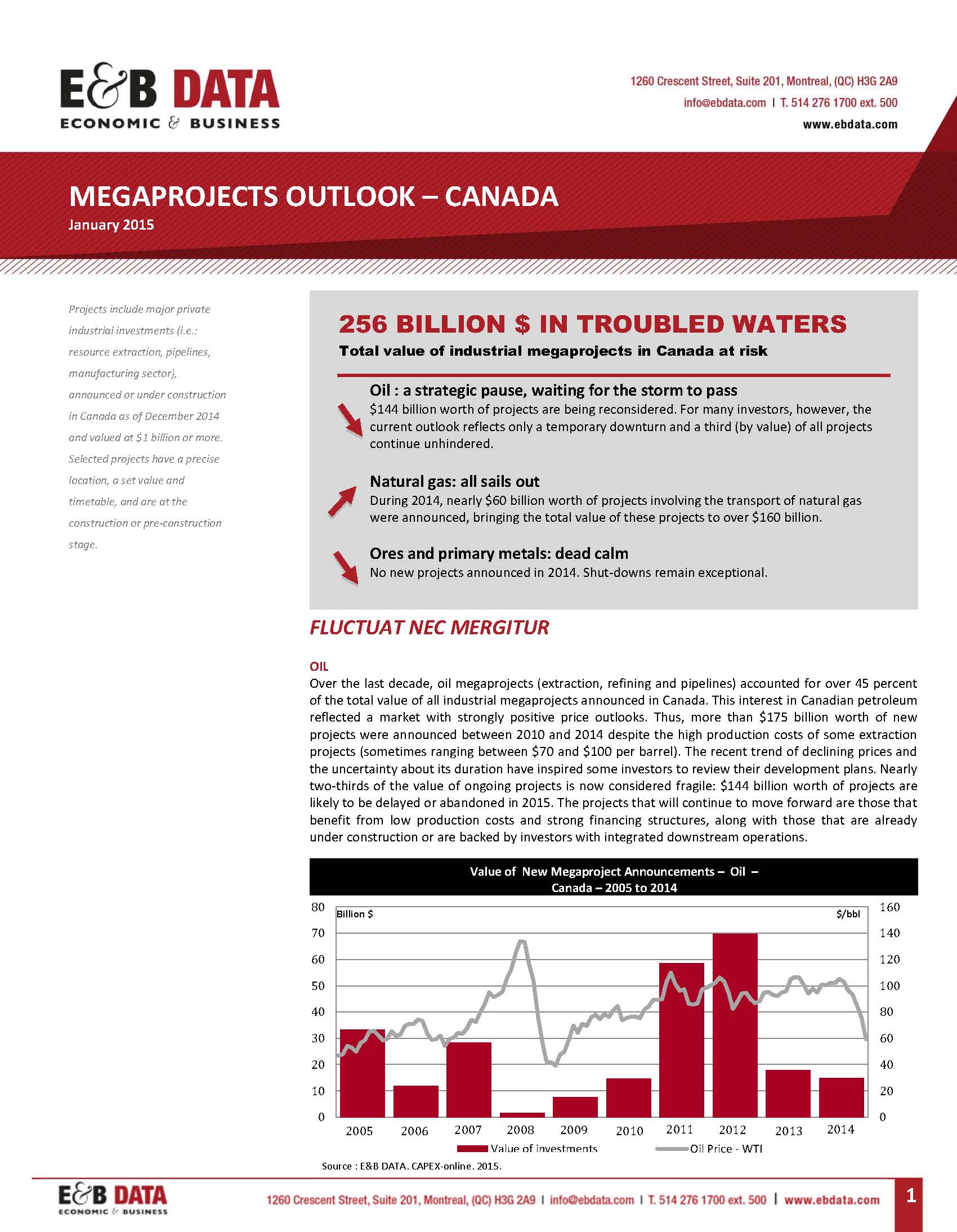

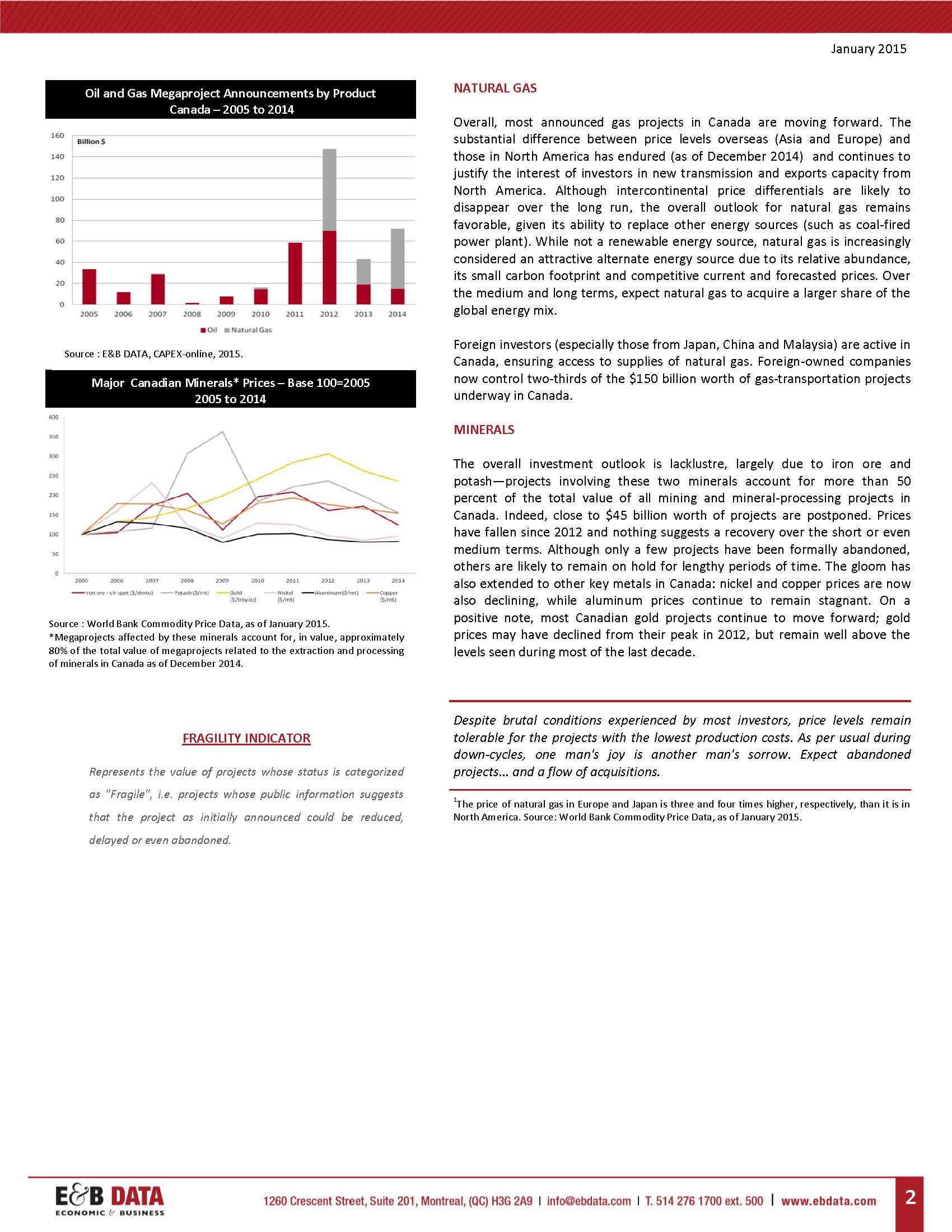

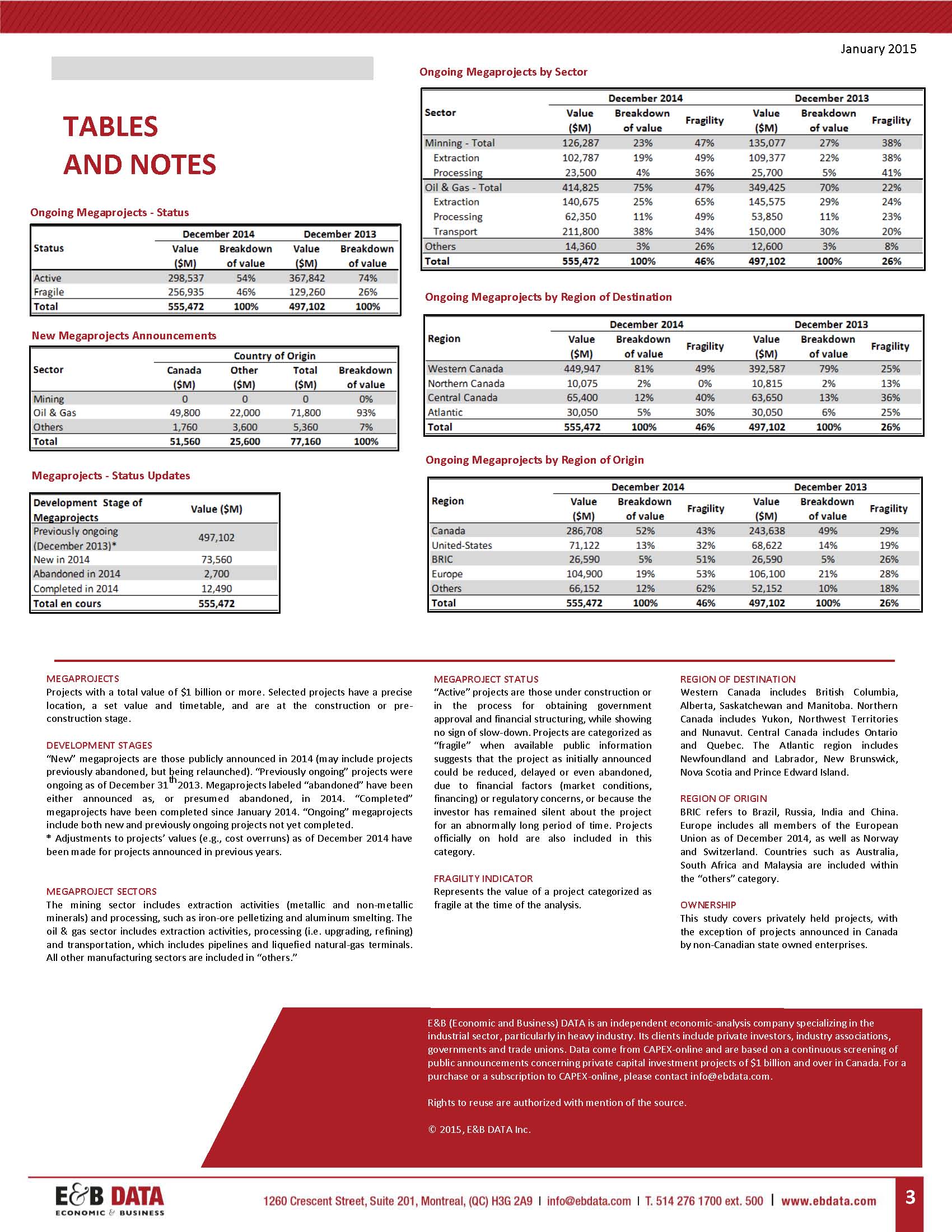

A Freeze on Large Private-Investment Projects and a Cooling of Canadian Consumer Spending: What Could Warm Up the Canadian Economy in 2015? February 10, 2015 (Hint: It will not be public-sector austerity policies) Of the $555 billion worth of megaproject investments in the natural-resources sector announced in Canada, 46 percent are now being delayed, reduced or at risk of being abandoned1. In addition to the turmoil in the oil sector, forecasts for 2015 are also distressing for Canada’s mining and metals sector: in fact, the price forecasts of iron, potash, nickel and copper have been revised downward by 20 percent since mid-20142. With global growth slowing, the fate of projects in these sectors is uncertain. Furthermore, if downward price trends continue, it will be a challenge just to maintain current production capacities. While a decline in the value of the Canadian dollar versus the U.S. dollar is expected to increase Canada’s exports of goods (80 percent of the total value of Canada’s exports of manufactured goods still goes to the U.S3), could accelerating investment in Canadian manufacturing compensate for declining investment in the natural resources sector? In short, the answer is no, largely due to the fact that natural-resources investment is so much more capital-intensive that most investment in manufacturing. At any rate, manufacturing attracts a relatively small share of total private industrial4 investment (less than 19 percent) in Canada and only a marginal share of total private investment (6 percent)5. Therefore, any manufacturing investment rebound would hardly have any visible impact on GDP growth. Will consumer spending increase, driven in part by lower energy costs? Or will households delay purchases in the face of current disinflation—which is spreading to other sectors, such as real estate—thus generating a deflationary dynamic? In a context where private investment (19 percent of Canada’s GDP) is cooling and levels of households’ (currently 55 percent of GDP)6 confidence suggest a more cautious consumer, the basis for strong endogenous economic growth in Canada is not solid. In fact, future Canadian growth might well be solely sustained by the growth of exports to the United States. After a few years of increasing economic independence vis-à-vis the United States, the Canadian economy could once again find itself mostly driven by the U.S. economy. Download our most recent publication Megaprojects Outlook: *******. [1] E&B DATA, « Fluctuat nec mergitur », Megaprojects Outlook. January 2015.

|

|